Financial Literacy, Credit Access and Financial Stress of Micro-Firms

Evidence from Chile

Lucas Rosso Fones

University of Chile

Author

Christopher (Casey) Lingelbach

Emily Belt

Orly Mansbach

Editors

Fall 2019

Abstract

In Chile, as well as in the majority of the economies in the world, there exists a wide range of programs targeted towards the support of micro-entrepreneurs, providing either funding for their projects or business training. Using the 2006 and 2009 Chilean Social Protection Survey (EPS) dataset, data from the Superintendence of Banks and Financial Institutions (SBIF), and using an instrumental variables (IV) approach, this article presents evidence against financial literacy training programs as it finds no significant relationship between financial literacy on credit access or financial stress of micro-firms. Moreover, using a subsample of the data, this article shows that the results must be interpreted as an “upper bound,” thus strengthening these conclusions.

I. Introduction

In Chile, as in most of the world, micro-firms—firms with 10 or fewer employees—play a substantial role in the performance of the economy by their contribution to production and employment. Therefore, over the last few years, authorities have developed several policies targeted to encourage entrepreneurial activities. These policies include business skills training, asset transfers and credit subsidies.

For example, since 2010, a large-scale government program run by the Chilean Ministry of Social Development offers an in-kind transfer of start-up capital plus 60 hours of business training to approximately 2,000 micro-entrepreneurs each year.

Due to this governmental interest in micro-firms, there is a wide literature that has studied the effect of micro-firm support on growth, unemployment, poverty, productivity, and other economic variables. Overall, the evidence leans toward a positive and statistically significant effect of credit-access programs on these variables; however, the evidence with respect to business skills is weaker.

Conversely, other studies have linked financial literacy with the probability of having access to credit and the level of debt, though these studies are usually at the individual or family level. For instance, Alvarez & Ruiz-Tagle provide evidence that financial literacy is positively related to credit access, but they find no significant evidence for financial stress.

Economic models of investment often rely on the assumption that firms decide the amount of capital and labor that maximizes their profit. This assumption is called the rationality of firms. Furthermore, these models evaluate the present value of the expected cash flows in relation to the initial investment. From the work of Modigliani & Miller it follows that, in a world with taxes, levered firms (companies with more debt than equity) have a greater value than non-levered firms, at the expense of a higher bankruptcy probability.

However, under the assumption of rationality of firms, these models are unable to take into account the lack of financial skills of those who run the firms, which might affect their decision-making and lead them to choose sub-optimal levels of debt. This issue is especially important in micro-firms due to the often limited human capital of their owners. Thus, it is likely that micro-firms with limited financial skills hold high levels of debt or fail to renegotiate their debts, which can affect the individuals’ utility through larger levels of poverty or unemployment, among other effects.

From a policymaker’s standpoint, there are two possibilities to support entrepreneurs: business training or funding support. On the one hand, business training intends to provide skills for better management of the business. For example, such training programs may provide client negotiation skills, marketing skills, working capital management, growth strategies, and more. On the other hand, funding support seeks to fix liquidity constraints which diminish the rise of new business and the prevalence and growth of existing ones. This paper intends to establish a causal relationship between financial literacy and both credit access and financial stress of micro-firms. Evidence in favor of a causal relationship would encourage the design of business training programs as a complement to the existing asset-transfer programs for micro-entrepreneurs.

Using data from the 2006 and 2009 Social Protection Survey (EPS) and information from the Superintendence of Banks and Financial Institutions (SBIF) this paper presents evidence against financial literacy programs for micro-firms given that it does not find statistically significant coefficients for either credit access or financial stress.

Nevertheless, a sharp reader may have concerns about the internal validity of the results as data restraints do not allow an experimental design for a specific policy. However, this paper tries to provide evidence regarding the effect of greater financial literacy on micro-firm financial decision making, giving broad conclusions on this matter and contributing to future policy design. In addition, as there are very few financial skill programs, it is unlikely that this may drive this paper’s results.

Additionally, due to the endogeneity of financial literacy (the correlation of the variable and the error term used in this model), this paper proposes an instrumental variable (IV) approach, using the number of banks at a township level as an instrument for financial literacy. As it will be argued later, this instrument satisfies both the relevance and exogeneity conditions.

Likewise, given the limited amount of observations that this sample contains, it is not possible to estimate the coefficients using the fixed effects model, which may drive this paper’s results.

For instance, it is reasonable to think that those who appear as micro-firm owners in both years are the ones with more financial literacy, causing biased coefficients due to a non-random attrition, the process by which the strength of the relationship gradually decreases. Hence, by comparing a pooled model with a subsample of individuals only from the EPS 2006, this paper establishes an “upper bound” for the estimated coefficients. Given that this paper finds no significant results, this work supports the evidence found on other business training studies, such as the results presented by Karlan & Valdivia.

The rest of the paper is divided into seven sections. Section 2 carries out a brief literature review. Section 3 describes the data, defines the main variables and presents some stylized facts. Section 4 presents the underlying economic model that sustains this investigation. Section 5 presents in detail the empirical model and discusses the main estimation problems. Section 6 shows the main results and robustness checks. Finally, section 7 presents conclusions and public policy recommendations.

II. Literature Review

There is a rich literature related to studying the effect of micro-entrepreneur support on poverty alleviation, unemployment, and other variables, especially regarding the evaluation of financial aid programs (credit subsidies, asset transfers, and more) and business training programs.

For instance, Bruhn & Love exploit the almost simultaneous opening of more than 800 bank branches in Mexico targeted to low-income individuals, using this event as a “natural experiment.” With this experimental design and using a difference-in-difference strategy (comparing areas that received banks to similar ones that did not across time), they present evidence of a positive relationship between credit access and poverty alleviation.

In the same way, Beck, Demirgüç-Kunt & Levine, using a dynamic panel at country level, find a negative and statistically significant relationship between credit access and inequality. This relationship is due to the heterogeneity in the improvement of credit access, being low-income individuals the ones who benefit the most from improved credit access.

Likewise, Levine, Loayza & Beck use both cross-section and dynamic panel approaches, as well as instrumental variables to find a negative relationship between financial intermediary development and economic growth. These results are in line with Aghion et al. which finds that higher credit restraints affect economies’ mean growth.

We now turn our attention to the mixed evidence of business training programs for micro-entrepreneurs, which cover a wide range of useful managing skills such as promotion skills, working capital management, and negotiation strategies. The work performed by Karlan & Valdivia or Almeida & Galasso fail to find significant evidence of business training programs for micro-entrepreneurs in Peru and Argentina. In contrast, Berge et al. and Bjorvatn & Tungodden find positive effects of human capital accumulation programs for micro-firm owners in Tanzania, while Mano & Iddrisu find the same in Ghana.

Moreover, considering micro-firm owners in Chile, Martinez, Puentes & Ruiz-Tagle use the MESP program and an experimental design to provide useful evidence regarding a positive relationship between a combination of an asset transfer and business training on employment and wages of low-income micro firm owners, most of whom are women. However, they are unable to study the effect of each component of the program by itself.

Examining financial literacy levels, literature focuses mainly on individual or family level. For example, Alvarez & Ruiz-Tagle, using an IV identification strategy, find some evidence related to wider credit access for households with higher financial literacy; however, they find no evidence for the levels of financial stress.

Regarding individuals, some evidence shows that lower understanding of financial concepts can trigger larger levels of debt and higher probability of default. Nevertheless, it is also important to consider that lower levels of financial literacy might suggest a lower propensity to sustain relationships with financial institutions.

Finally, considering micro-firm support programs, the work performed by Drexler et al. studies the effect of two types of financial skill training programs in the Dominican Republic. The first provides standard classes covering accounting and financial contents while the second offers basic classes teaching rules of thumb of finance and accounting. Among their results, the authors conclude that lower-complexity courses are more effective on financial decision-making of the treated. Despite not finding significant effects on profit or sales of any of the programs, they find some evidence of an increase in bad week sales.

Overall, literature tends to lean in favor of a positive relationship between credit access and different variables related to utility of economic agents. However, evidence is mixed regarding business training programs. Further, these programs rarely focus on financial literacy or link this variable to the probability of having access to credit (at least not at a micro-firm level) despite its potential relevance in explaining the firm's liquidity constraints. Therefore, this paper seeks to provide evidence for the relation between financial literacy and the two dependent variables of interest: credit access and financial stress, with the purpose of public-policy recommendations.

III. Data and Stylized Facts

The data used for this work comes mainly from the Chilean Social Protection Survey (EPS), specifically the surveys of 2006 and 2009. This paper also uses data from the Superintendence of Banks and Financial Institutions (SBIF), which provides information on the distribution of bank branches at a township level, to create the instrument proposed in this paper.

In both the EPS 2006 and the EPS 2009, the surveys interview roughly 15,000 households with a total of 81,096 and 74,047 observations, respectively. That being said, this paper only considers individuals that declare being owners or partners of some business. Furthermore, defining micro-firms according to the amount of workforce, this paper drops every business with more than 10 workers. Ultimately, after cleaning the database, 935 observations remained, of which 575 come from the EPS 2006 and 360 from the EPS 2009.

One of the greatest strengths of the EPS is that it has a section of questions related to financial knowledge and the risk aversion of the individual. That section allows this paper to develop a Financial Literacy Index (FLI) and a risk aversion index, both in line with the ones presented by Flores, Landerretche & Sanchez.

Moreover, consistent with Alvarez & Ruiz-Tagle, this paper defines financial stress as the debt to income ratio. In this matter, financial stress is defined as the total amount of debt related to business reported by the interviewee, divided by his mean annual income. Moreover, a proxy for the formality of the business is created by generating a dummy variable that takes the value of one when the firm declares sales taxes and zero if not. In Table 1 there is a summary of the main variables used for this investigation.

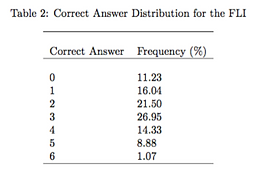

Regarding FLI, on average, individuals interviewed answered correctly to 41 percent of the questions. Table 2 shows the distribution of correct answers. Surprisingly, just 1.07 percent of the sample answered correctly to the six questions of basic financial concepts and less than 25 percent of those interviewed responded correctly to more than half of the questions. Moreover, regarding the compound interest rate question, which is arguably the most important question when establishing a relationship with a financial institution because loans are calculated over a compound interest rate, just a 2.78 percent answered correctly. This number is considerably lower than the one found by Lusardi & Mitchell for baby boomers in the US, which was around 18 percent.

Looking at credit access and financial stress, only 16 percent of the sample has some debt when interviewed, while the mean debt represents 19 percent of the individual annual income. Nevertheless, this last number is mainly driven by the relationship (or lack of relationship) with the financial institutions. Moreover, conditional on having a loan, financial stress rises to 14.3. However, despite the magnitude of the mean, it is important to consider that this debt considers long run loans such as land or equipment loans. Appendix 3 shows the means for these variables by sex and age, showing that individuals between 24 and 54 years old have greater levels of financial stress as well as the largest share of individuals that participate in the financial markets.

Now this paper proceeds to look at the township-level distribution of bank branches. Townships have on average 36 bank branches. However, it is important—especially for a geographically unique country like Chile—to consider the heterogeneity of the data given the concentration of bank branches within the wealthiest, more urbanized and more educated townships, like the ones in the Metropolitan Region. Appendix 4 details the distribution of bank branches by regions. For example, there are 75.8 bank branches in each township from the Metropolitan Region, while in the third region the number goes down to 6.1.

IV. Theoretical Framework

For a better understanding of the empirical strategy, it is essential to rely on a theoretical model that provides an economic interpretation for the results obtained. As mentioned earlier in this paper, assuming that the firms evaluate business projects using a simple stochastic model of present value, this statement can be formalized with the following equation:

(1) Yt=-I0+i=1niEtt

Where Yt is the expected present value of the project in t, yt is the cash flow on period t, δ∈ (0,1) corresponds to the discount rate, and Et is the expectation operator, conditional on the set of information t. This expression is a simplification of the one proposed by Campbell & Shiller, which is very useful for the purposes of this investigation.

If we assume that not all of the individuals have access to the same set of information t, or they do not understand completely all the information available, it is reasonable to think that some entrepreneurs might forecast their cash flows incorrectly. This will likely affect the expected present value of the project; thus, these estimations can compromise the firm’s liquidity or restrain their access to external funding due to lack of information. Likewise, wrong cash flow estimations might affect the firm’s decision whether to invest or not, as well as their growth possibilities given that projects are subject to the condition Yt > 0.

A key assumption of this model is that individuals overestimate their cash flows as the result of a smaller set of information, which will be called t'. This can be taken from the evidence presented by Agarwal, Driscoll & Laibson who show that on the mortgage market, individuals fail to minimize their debt costs, which can be extensible to other types of debt. In that case, individuals underestimate the debt cost as they do not understand how much they pay nor their options associated with their loan. One clear example is that, on the compound interest question (see Appendix 1), 96.3 percent of those interviewed answered incorrectly and 29.3 percent of those interviewed answered as if it was a simple interest rate, which reaffirms the conclusions of Agarwal et al.

Therefore, considering the assumptions mentioned above, we have that:

(2) Yt-Yt'=i=1niEtt-Ett'<0

In which the right-hand expression would be the present value of the estimation error, which depends on the information gap t-t'. Thus, the bigger the information asymmetries, the less accurate the estimations for projects run by entrepreneurs with limited access to information—or in this case, entrepreneurs with low financial literacy—will be. In addition, this model, sustained by the evidence presented by Agarwal et al. predicts that the transmission channel for illiteracy will be related to costs, not income.

Another important factor is the decision of individuals to increase their stock of financial knowledge. It is easy to see that increasing financial skills endowment has costs and benefits. On the one hand, benefits are related to the model shown above as they allow better access to information and hence allow the individuals to make better investment decisions. On the other hand, the process of acquiring basic financial knowledge takes time and resources, which implies costs. Overall, theory predicts that individuals optimally choose the stock of financial knowledge that maximizes their welfare, as formalized by Jappelli & Padulla. However, this model runs out of the main goal of this investigation.

Finally, it is important to mention that, according to the theoretical model presented by Modigliani & Miller, in the presence of information asymmetries between firm owners and the market, levered companies are more valuable as they signal a low bankruptcy probability to the market. This would generate, consistent with the work of Ross, an incentive to be levered. This statement generates some concern regarding the prediction that firms with bigger financial stress have owners with lower financial literacy.

V. Identification Strategy

For the identification strategy, two models are estimated in parallel: one for financial stress and the other for the dummy variable of credit access. As such, this paper estimates the following equation:

(3) Yit=Xitβ+δFLIit+t+it

In which Yit represents the two dependent variables, financial stress and credit access, for each specification. Xit is a vector of individual control variables (such as education, age, or gender) and firm control variables as a dummy for formality, business age, and amount of workforce. t corresponds to a dummy variable that takes value 1 for year 2009 and 0 for 2006, to control for year-fixed effects. Our parameter of interest, FLI, corresponds to the financial literacy index, which consists of the amount of correct answers from the set of financial questions of the EPS (see Appendix 1 for more detail). it is the error term of the model. Finally, I use robust standard errors to control for possible heteroscedasticity.

Regarding the variable of interest of this work, there are reasons to believe that it presents endogeneity issues due to measurement errors of the index or spillovers from those who participate actively in financial markets, as explained by Alvarez & Ruiz-Tagle. The first issue is a result of the noisy nature of financial literacy, while the second occurs because some financial concepts might be learned by participating in financial markets.

It is well known that measurement errors on right-side variables will tend to bias the coefficients towards zero, while spillovers are expected to bias the FLI upwards. Therefore, given that both sources of bias operate on opposite directions, the end result will depend on which effect is dominant.

In order to tackle the problem of endogeneity, this paper suggests an IV approach, using the amount of bank branches at a township level as an instrument for the FLI. This instrument can be considered exogenous for the financial stress variable as there is no theoretical reason to believe that this might correlate with the level of financial literacy of the interviewee. However, when analyzing access to credit, the relationship is more plausible, because micro-entrepreneurs can choose where to set up their business. That being said, the EPS dataset does not ask for the township in which the business is located, but for the township where the individual lives. Individuals likely did not decide to live in a township due to the supply of financial institutions, but rather due to the accessibility of the township, supply of education establishments, green area supply, compatibility with neighbors, and other variables. Thus, this IV fulfills the exogeneity condition on both specifications. Then, the first stage regressions can be written:

(4) FLIict=Xitβ+δBct+t+ict

In which Bct would be the number of bank branches on the township c.

Another problem related to the estimations is that, when using a pool sample with observations of the EPS 2006 and 2009, it is likely that there will be non-random attrition bias if the reason to disappear from one survey to another is correlated with the FLI. Furthermore, one can think that those interviewed with lower financial literacy will have a higher bankruptcy probability and therefore lower probability to declare being a business owner on the EPS 2009, generating upward biases. The next section tackles this issue and reaffirms the robustness of the results obtained.

VI. Main Results and Robustness Checks

Table 3 shows the main results of both dependent variables. Columns 1 and 3 show the estimations using Ordinary Least Squares (OLS) with year fixed effects while column 2 and 4 show the results using IV. We notice that for none of the specifications is there a statistically significant coefficient for the FLI; however, in column 2, the coefficient is almost significant at a 10 percent level (p-value of 0.117). Also, we can see that coefficients are considerably larger when using an IV approach, which suggests that the attenuation bias (the underestimation of the absolute value of this data caused by errors in the independent variable) dominates the spillover effect of those who participate on the financial markets.

These results are similar to the ones obtained by Alvarez & Ruiz-Tagle, in which they argue that the positive relationship between financial literacy and financial stress might be explained by greater credit access or overconfidence of the more literate individuals. The positive relationship between the FLI and the probability of having access to credit also has the expected sign; however, the significance is weaker than the one presented by Alvarez & Ruiz-Tagle.

The lower panel of Table 3 shows the main results of the first stage. Shown in both models, the number of bank branches fulfills the condition of relevance as the F test is greater than 10 and the coefficients are highly significant in both specifications.

Regarding the control variables, the reader can see that they all go in the expected directions. However, this paper believes it is important to discuss in detail the formality dummy variable, given that the coefficient is negative and statistically significant for credit access. At first, intuition would suggest a positive relationship between the formality of the business and the probability of getting a loan and its financial stress. Further, one would expect that formally constituted companies should have better access to request a loan on a financial institution. However, it is likely that for micro-firms as the ones studied in this paper, obtaining a loan as a formal company is more of a restraint than an advantage. The reason is very simple: an individual can leave personal assets such as his/her house or car as collateral, which reduces the bank’s risk, so unincorporated companies would take more loans than formal companies.

Overall, these results suggest that business training programs related to financial skills would not be effective to diminish the financial stress (and with that the survival probability) nor the probability of having access to credit of micro-firms, as better financial literacy has no significant effect on either of these variables. Thus, a more effective policy design would be related to providing asset transfers and loan subsidies, consistent with the empirical evidence shown in the literature review.

A. Robustness Checks

Given that the pooled model presented in the previous subsection has observations for micro-entrepreneurs from years 2006 and 2009, it is likely that these results may be biased due to non-random attrition, in which the results gradually decrease in strength. Intuitively, it is reasonable to think that those who report themselves as micro-firm owners on both the 2006 and 2009 surveys are the ones with higher financial literacy levels (as financial literacy would be a useful tool for making optimal financial decisions and diminish the probability of bankruptcy), which would generate upward bias on the estimations presented in Table 3. In that case, results shown before should be interpreted as an “upper bound,” proving solid evidence against a causal relationship between financial literacy and the two dependent variables studied for this investigation.

In order to test this hypothesis, this paper estimates again columns 2 and 4 of Table 3, but only for a subsample of year 2006 observations. If the hypothesis is true, both the significance and the coefficients must fall on this new specification. Table 4 shows the results obtained from this subsample, using the IV approach as on columns 2 and 4 of Table 3.

From the table above, one can see that the results obtained are consistent with this paper’s hypothesis, as the coefficients (and their p-values) fall on both specifications when using the subsample of observations from 2006. For financial stress, the estimated coefficient falls from 3.899 to 1.698 (and the p-value increase from 0.12 to 0.36), while credit access falls from 2.693 to 2.117 (p-value changes from 0.21 to 0.30).

One possible concern regarding these results is that they can be driven by the narrowing of the sample, as for the pooled model the sample was already limited on observations. However, one can see that the standard error falls when the regressions are estimated for the subsample of the year 2006, despite reducing the size of the sample. Furthermore, the instrument bank branches on township is still highly significant (at a 99 percent level for both specifications) and has an F test of 11.54.

This implies that the results shown on Table 3 should be interpreted as an “upper bound,” due to the attrition bias, presenting robust evidence against financial training programs, as there is no significant relationship between financial literacy and access to credit or financial stress of micro-firms.

VII. Final Conclusions

This paper intended to establish a causal relationship between the financial literacy level of micro-entrepreneurs, their probability of having access to financial markets, and their financial stress. Based on the literature regarding this subject and given the large empirical evidence in favor of financial aid programs for micro-firms, as well as the mixed results in business training programs, this paper intended to contribute new evidence relative to the effectiveness of policies that involve business training for micro-firm owners.

By using an instrumental variables approach, this paper tried to tackle the endogeneity problems that the financial literacy index (created following Flores, Landerretche & Sanchez) is exposed to. This paper uses the number of bank branches at a township level as an instrument for the index, which fulfills both the exogeneity and relevance conditions. Overall, my results suggest that there is no causal relationship between financial literacy and the two dependent variables studied. Further, due to non-random attrition bias, these results must be interpreted as an “upper bound” which provides solid evidence against financial training programs.

Finally, for future investigations, it would be useful to check the external validity of the model and see if the results hold for other datasets in Chile or other middle-income countries. It would be also relevant to know if the conclusion on financial training projects holds for other variables, such as the probability of default.

Works Cited

Agarwal, S., J. C. Driscoll & D. I. Laibson. “Optimal Mortgage Refinancing: A Closed-Form Solution.” Journal of Money, Credit and Banking, vol. 45, no. 4, 2013, pp. 591–622.

Aghion, P., Angeletos, G. M., Banerjee, A., & Manova, K. Volatility and growth: Credit constraints and productivity-enhancing investment. National Bureau of Economic Research, no. w11349, 2005.

Akerlof, G. A. “The market for “lemons”: Quality uncertainty and the market mechanism.” Uncertainty in Economics, 1978, pp. 235-251.Alvarez, R., Ruiz-Tagle, J. Alfabetismo financiero, Endeudamiento y Morosidad de los Hogares en Chile, University of Chile, 2016.

Almeida, R. K., & Galasso, E. “Jump-starting self-employment? Evidence for welfare participants in Argentina.” World Development, vol. 38, no. 5, 2010, pp.742-755.

Atkinson, A., & Messy, F. A. “Promoting financial inclusion through financial education.” OECD Working Papers on Finance, Insurance and Private Pensions, no. 34, 2013.

Beck, T., Demirgüç-Kunt, A., & Levine, R. “Finance, inequality and the poor.” Journal of Economic Growth, vol. 12, no.1, 2007, pp. 27-49.

Beck, T., & Demirguc-Kunt, A. “Small and medium-size enterprises: Access to finance as a growth constraint.” Journal of Banking & Finance, vol. 30, no. 11), 2006, pp. 2931-2943.

Berge, L. I. O., Bjorvatn, K., & Tungodden, B. “Human and financial capital for microenterprise development: Evidence from a field and lab experiment.” Management Science, vol. 61, no. 4, 2014, pp. 707-722.

Behrman, J. R., Mitchell, O. S., Soo, C., & Bravo, D. Financial literacy, schooling, and wealth accumulation. National Bureau of Economic Research, no. w16452, 2010.

Bjorvatn, K., & Tungodden, B. “Teaching business in Tanzania: Evaluating participation and performance.” Journal of the European Economic Association, vol. 8, no. 2-3, pp. 561-570.

Bruhn, M., & Love, I. “The real impact of improved access to finance: Evidence from Mexico.” The Journal of Finance, vol. 69, no. 3, 2014, pp. 1347-1376.

Campbell, J. Y., & Shiller, R. J. “Cointegration and tests of present value models.” Journal of Political Economy, vol. 95, no. 5, 1987, pp. 1062-1088.

Card, D. “The causal effect of education on earnings.” Handbook of Labor Economics, vol. 3, 1999, pp. 1801-1863.

Deaton, A. Saving and liquidity constraints. National Bureau of Economic Research, no. w3196, 1989.

Pilar de la Barra. “Efecto de la Educación en Comportamiento de Toma de Deuda: Evidencia para Chile,” Tesis de Magíster, Pontificia Universidad Católica, 2014.

Drexler, A., Fischer, G., & Schoar, A. “Keeping it simple: Financial literacy and rules of thumb.” American Economic Journal: Applied Economics, vol. 6, no. 2, pp. 1-31.

Flores, B., Landerretche, O., & Sánchez, G. Propensión al emprendimiento: ¿Los emprendedores nacen, se educan o se hacen?. 2011.

Gale, W., & Levine, R. Financial Literacy: What Works? How Could It Be More Effective?

The Brookings Institution, 2010.

Gerardi, K., Goette, L., and Meier, S. "Financial Literacy and Subprime Mortgage Delinquency: Evidence from a Survey Matched to Administrative Data." SSRN Electronic Journal, 2010.

Hansen, B., Econometrics, 2016.

Jappelli, T. and Padula, M. ‘Investment in financial literacy and saving decisions’, Centre for Studies in Economics and Finance, University of Naples Frederico II, CSEF Working Paper no. 272, 2011.

Karlan, D., & Valdivia, M. “Teaching entrepreneurship: Impact of business training on microfinance clients and institutions.” Review of Economics and Statistics, vol. 93, no. 2, 2011, pp. 510-527.

Landerretche, O. y C. Martínez “Voluntary Savings, Financial Behavior, and Pension Finance Literacy: Evidence from Chile,” Journal of Pension Economics and Finance, vol. 12, no. 03, 2013, pp. 251-297.

Levine, R., Loayza, N., & Beck, T. “Financial intermediation and growth: Causality and causes.” Journal of Monetary Economics, vol. 46, no. 1, 2000, pp. 31-77.

Lusardi, A., & Tufano, P. “Debt literacy, financial experiences, and overindebtedness.” Journal of Pension Economics Finance, vol. 14, no. 4, 2015, pp. 332-368.

Mano, Y., Iddrisu, A., Yoshino, Y., & Sonobe, T. “How can micro and small enterprises in sub-Saharan Africa become more productive? The impacts of experimental basic managerial training.” World Development, vol. 40, no. 3, 2012, pp. 458-468.

Martínez, A., Puentes, E., & Ruiz-Tagle, J. “The effects of micro-entrepreneurship programs on labor market performance: experimental evidence from Chile.” American Economic Journal: Applied Economics, vol. 10, no. 2, 2018, pp. 101-24.

Modigliani, F., & Miller, M. H. “Corporate income taxes and the cost of capital: a correction.” The American Economic Review, vol. 53, no.3, 1963, pp. 433-443.

Ross, S. A. “The determination of financial structure: the incentive-signalling approach.” The Bell Journal of Economics, 1977, pp. 23-40.

Saavedra, M. L., & Hernández, Y. “Caracterización e importancia de las MIPYMES en Latinoamérica: Un estudio comparativo.” Actualidad Contable Faces, vol. 11, no.17, 2008.

Staiger, D. O., & Stock, J. H. Instrumental variables regression with weak instruments, 1994.

Appendices

Appendix 1: Creation of Variables

(a.) Financial Literacy Index (FLI): Consistent with Flores et al., we designed an index following the next set of questions and the number of correct answers:

• Question 1: Probability. If there is a 10 percent chance of getting a disease, How many people will catch the disease out of 1000?

• Question 2: Lottery Division. If five people hold the same winning ticket from a lottery of $2 million, how much will each receive?

• Question 3: Interest rate. Assume that you have $100 in a savings account and the annual interest rate that you receive for this savings is 2 percent. If you keep the money for 5 years on this account, how much money will you have in five years from now?

a. More than $102

b. Exactly $102

c. Less than $102

• Question 4: Compound rate. Let’s say you have $200 in a savings account, which accumulate 10 percent in return each year. How much would you have after two years?

• Question 5: Inflation. Suppose you possess $100 in a savings account which gives you a return rate of 1 percent yearly. If the inflation is 2 percent, after one year you could buy:

a. More than $100

b. Exactly $100

c. Less than $100

• Question 6: Risk diversification. Please answer if the next statement is true or false: buying a stock form a company is less risky than buying the same money on several stocks from different companies

(b.) Likewise, I use the following risk aversion index proposed by Flores et al. (2011).

Risk aversion:

• Is 0 if the interviewee prefers a fixed and stable income for the rest of his life

• Is 1 if he/she prefers a job in which he/she can, with the same probability, have twice his income

or 3/4 of his income for the rest of his life.

• Is 2 if the interviewed prefers a job in which he/she can, with the same probability, have twice his income or 1/2 of his income for the rest of his life

• Is 3 if the interviewed prefers a job in which he/she can, with the same probability, have twice his income or 1/4 of his income for the rest of his life

(c.) Type of debts considered for the Financial Stress variable:

• Machinery

• Land and/or agricultural facilities

• Animals (cattle)

• Bank credit line

• Other

Appendix 2: Financial Literacy Index

Appendix 3: Descriptive Statistic for FLI and Dependent Variables

Appendix 4: Bank Branches Distribution in Chile

Appendix 5: Regressions for Financial Stress and Credit Access Detail

Appendix 6: Regressions for Subsample Year 2006

Appendix 7: Instrumental Variables